Angola's National Oil, Gas & Biofuels Agency will launch a limited tender in Q1 2025, offering 10 blocks in the Kwanza and Benguela Basins – including 5 marginal fields – marking a first for the country. Amid efforts to entice investment in blocks opportunities, the ANPG is inviting companies to participate in the upcoming licensing round. Negotiations are already open and companies are invited to contact the ANPG ahead of the official licensing launch.

To support investment, the African Energy Chamber (AEC), ANPG and EnerGeo Alliance hosted a webinar to discuss exploration opportunities in Angola. The webinar comes ahead of international conferences taking place in Cape Town – African Energy Week: Invest in African Energy and Angola – Angola Oil & Gas – and drew insight into mature and frontier prospects in Angola.

As sub-Saharan Africa’s second biggest oil producer, Angola offers a wealth of opportunities for E&P players. While production averaged 1.8 million barrels per day (bpd) between 2009 and 2015, national output saw a sharp decline from 2016 onwards owing to field maturation. The government has been working hard to address these declines, introducing regular block opportunities through tenders and permanent offer programs.

“We have been implementing a series of reforms. We approved a strategy in 2019 to license more than 50 blocks by 2025. So far, we have executed four licensing rounds and awarded more than 30 new concessions. We have another one planned for 2025 where we are projecting to put up another ten blocks offshore,” stated Alcides Andrade, ANPG Board Member.

Industry reforms have seen companies that have been operating in the country since the 1900s continue to invest. These include energy majors TotalEnergies, Chevron, bp and Eni – now operating as Azule Energy. Reforms have also been directed towards incremental production efforts to maximize output at existing fields.

According to Andrade, “The plan is to do everything we can to keep production above one million bpd. We are currently producing about 1.1 million bpd and have a diverse range of opportunities for different size companies as well as opportunities in onshore blocks, shallow waters and deepwater opportunities.”

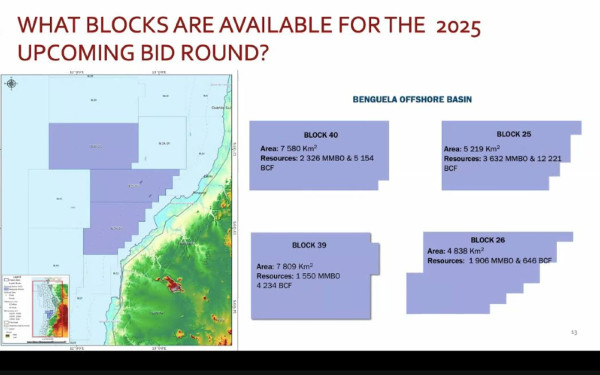

Angola’s 2025 limited tender will feature Block 40, Block 25, Block 39 and Block 26 in the Benguela Basin as well as Block 22, Block 35, Block 37, Block 38 and Block 36 in the Kwanza Basin. Additionally, the country has four onshore blocks available; 11 blocks on permanent offer; and five marginal fields ready for exploration. The marginal fields are situated in producing blocks with proven systems and can be awarded individually. Companies that demonstrate interest will receive an invitation letter once the 2025 tender launches.

In addition to block opportunities, the ANPG is committed to strengthening sub-surface data across both mature and frontier fields. At present, Angola’s basins offer a library rich with 2D and 3D seismic data, however, more data is required to support exploration efforts. Ross Compton, Director: Global Policy, Energeo Alliance, stated that “The exploration industry is making energy possible for the world. Africa needs energy for industrialization, the movement of goods and people and climate resilience. We believe that through collaboration both within Africa and Angola is very bright and EnerGeo Alliance is ready to partner…”

Verner Ayukegba, Vice President, AEC, emphasized the wealth of opportunities that are available across Angola’s oil and gas industry, underscoring that investing in Angola has never been more attractive.

“Let’s capitalize on these opportunities that are readily available. We look forward to welcoming to Angola Oil & Gas (AOG), where these opportunities and many others will be on display. Book your tickets to meet ANPG in Angola from October 2-3,” he said.

The webinar comes ahead of the AOG 2024 Conference & Exhibition, the country’s premier event for the oil and gas industry.

Returning for its fifth edition from October 2-3 in Luanda, AOG 2024 takes place under the theme Driving Exploration and Development Towards Increased Production in Angola and connects investors to project opportunities in Angola. For more information, visit www.AngolaOilandGas.com.

The webinar also serves as a precursor to the African Energy Week: Invest in African Energy conference, taking place from November 4-8 in Cape Town. Representing the biggest energy event on the continent, the conference takes place under a mandate to make energy poverty history by 2030 and promotes investment in oil and gas in Africa. Companies interested in Angola’s oil and gas opportunities will gain insight into available acreage and partnership prospects at this year’s event. A dedicated Invest in Angola Energies session functions as a platform to connect companies while delving into exploration, production and infrastructure projects. For more information, visit www.AECWeek.com.

Distributed by APO Group on behalf of African Energy Chamber.