Africa is set to be the second-fastest growing region in the world after Asia in 2023-24, demonstrating the resilience of its economy despite dealing with multiple global shocks.

But the projected growth will depend on global conditions and the continent’s ability to bolster its economic resilience, the African Development Bank’s 2023 African Economic Outlook report has found.

The report, launched on Wednesday, forecasts that Africa will consolidate its post-Covid-19 pandemic recovery to 4.3% GDP growth in 2024 from 3.8% in 2022. Some 22 countries will record growth rates above 5%, it says.

It recommends robust policy actions, including incentivizing green industries and providing guarantees at scale to de-risk private sector investments in managing natural capital across the continent.

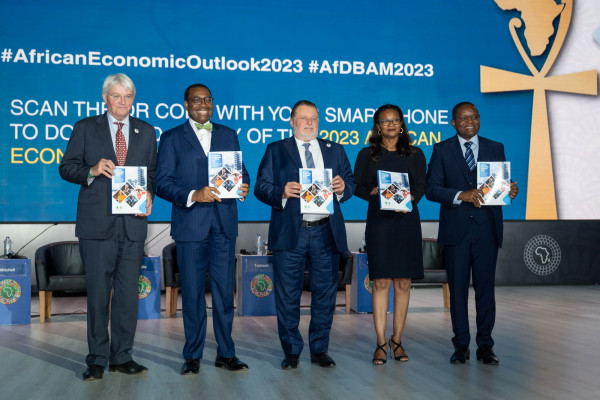

The launch, attended by African leaders, experts and development partners, was one of the highlights of the Bank Group’s Annual Meetings in Sharm El Sheikh, Egypt. It was under the theme, Mobilizing Private Sector Financing for Climate and Green Growth.

The Bank Group’s Chief Economist and Vice President for Economic Governance and Knowledge Management, Prof. Kevin Urama, presented the report’s findings, outlining several potential policy actions for stimulating more private sector financing for climate and green growth in Africa.

These options include tapping into the expanding global and domestic private equity and venture capital appetite for African markets and “cautiously engaging with the emerging carbon markets and debt-for-climate swaps,” Urama said.

Unveiling the 220-page report, African Development Bank Group President Akinwumi Adesina said African countries must do more, including mobilizing more domestic resources and restructuring debt to withstand global headwinds.

“African economies are moving in the right direction,” Adesina said, noting that five of the six pre-pandemic top-performing economies are set to be back in the league of the world’s 10 fastest-growing economies in 2023–2024.

“But as we gather today, the world is facing multiple challenges, including climate change, inflation driven by higher prices of energy, commodities, and disruption of supply chains due to the ongoing Russia-Ukraine war,” he said.

The bank chief also pointed out that monetary tightening in the United States and Europe has led to rising interest rates that have compounded debt service payments for African countries.

During a panel discussion of the report, UK’s Minister of State and African Development Bank Group Governor Andrew Mitchell called for a review of the global financing architecture to unlock more green investments in developing countries, particularly Africa.

He mentioned some of the United Kingdom’s support to the continent, including providing guarantees through regional multilateral financial institutions such as the African Development Bank.

Mitchell commended the Bank Group’s leadership role in rallying global partners to mobilize financing at scale to tackle cross-cutting issues and improve capital wealth management.

“A lot of ideas are coming from the African Development Bank to grow partnerships to mobilize financing and we need to drive that going forward,” he said.

Admassu Tadesse, President and Group Managing Director of Eastern and Southern Trade and Development Bank, said he found as striking the report’s focus on the scope to leverage natural capital.

“For this report to be highlighting that in Sharm El Sheikh where COP27 took place, I think it is timely,” he stressed.

Acting Egypt’s central bank governor Hassan Abdallah called for a balance in the mix of innovation and long-term credit for green initiatives.

Dr. Heike Harmgart, Managing Director for Southern and Eastern Mediterranean region, European Bank for Reconstruction and Development, mentioned a recent approval by shareholders of the Bank to expand development assistance to sub-Saharan Africa.

She said: “We are keen to support green growth, working with our partners. We want to see how we can work with the African Development Bank to accelerate growth in Africa.”

Mr. Christophe Bories, Deputy Director of Multilateral Financial Affairs and Treasury Development in France, also commended the report for “clearly showing the strengths and weaknesses of African economies.” This will allow policymakers to make the right decisions, he added.

The African Economic Outlook report is the Bank Group’s flagship annual publication that provides compelling, up-to-date evidence and analysis to inform policy decisions.

While highlighting the challenges, the 2023 African Economic Outlook mainly focuses on opportunities to unlock private investments and know-how and tap the continent’s vast natural capital to combat climate change and spur the transition to green growth.

Please click here for the report.

- Dr. Adesina’s statement (https://apo-opa.info/3omsXvu)

Distributed by APO Group on behalf of African Development Bank Group (AfDB).

Contact:

Kwasi Kpodo

Communication and External Relations

media@afdb.org

About the African Development Bank Group:

The African Development Bank Group (AfDB) is Africa’s premier development finance institution. It comprises three distinct entities: the African Development Bank (AfDB), the African Development Fund (ADF) and the Nigeria Trust Fund (NTF). On the ground in 41 African countries with an external office in Japan, the AfDB contributes to the economic development and the social progress of its 54 regional member states. For more information: www.AfDB.org