Sun Exchange (www.SunExchange.com) has secured $2.5 million in the form of a convertible note from ARCH Emerging Markets Partners Limited’s Africa Renewable Power Fund (ARPF); This follows ARPF’s previous investment of $3 million as the lead investor in the Sun Exchange Series A funding round.

Sun Exchange, a crowd-based global solar leasing platform, today announced it has secured $2.5 million in convertible note financing from ARPF, a Mauritian private equity fund advised by London-based ARCH Emerging Markets Partners Limited (ARCH) (https://bit.ly/3kWDau2). This follows the company’s close of a $4 million Series A funding round in 2020, led by a $3 million investment from ARCH (https://bit.ly/3B0ZhVC).

The latest investment enables Sun Exchange to continue scaling its success using its crowd-based solar leasing platform to facilitate solar power for small-to-medium organisations in Sub-Saharan Africa, the segment most impacted by rising energy costs, unreliable grid infrastructure and costly backup diesel generators.

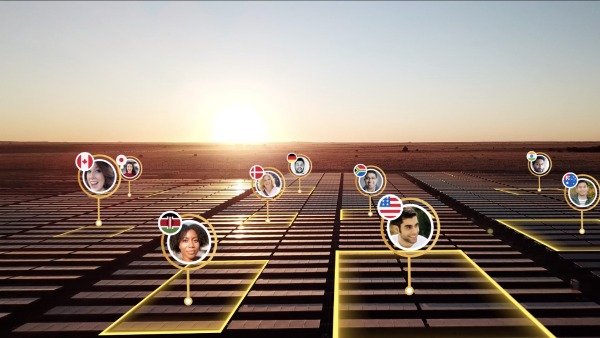

Through its innovative platform, Sun Exchange has facilitated solar power for 45 businesses, schools, farms and other organisations in Southern Africa. In March, the company successfully completed a $1.4 million crowdsale for a landmark 500 kW solar and 1 MWh battery storage project (https://bit.ly/3AWLUpu) for agriculture leader, Nhimbe Fresh. The project, Sun Exchange’s largest to date and first outside of South Africa, is also the largest crowdsourced project in Africa to date. Using the Sun Exchange platform, more than 1,700 people from 98 countries bought solar cells that will soon power the Nhimbe Fresh packhouse and cold store facilities. Construction of the solar plant is now underway.

William Barry, Managing Director, ARCH (Renewable Energy Strategy), said, “Sun Exchange continues to demonstrate momentum as a fast-emerging leader eliminating obstacles to solar proliferation in Africa. ARCH is committed to working with our portfolio companies and supporting their growth, and we are proud to continue partnering with Sun Exchange on its journey to accelerate the global energy transition.”

Abraham Cambridge, CEO & Founder, Sun Exchange, said, “Addressing the climate emergency is the top priority on the world’s agenda, as evidenced by last week’s conversations at the UN General Assembly leading up to COP26. While policy action and diplomacy are critical at this juncture, the private sector and individuals have a crucial role to play. Powered by our global community, Sun Exchange closes the solar finance gap for organisations in Africa, addressing the challenge of our lifetime while supporting sustainable economic growth. We are delighted that ARCH has reaffirmed its belief in Sun Exchange and our mission through this investment.”

Through Sun Exchange, anyone, anywhere in the world can easily buy solar cells and automatically lease them to be installed in high-impact solar projects, powering businesses and organisations in sunny emerging markets. Solar cell owners offset their carbon footprint while earning from the clean electricity generated. In turn, businesses and organisations can go solar at no upfront cost, minimising their energy costs and climate impact.

Distributed by APO Group on behalf of The Sun Exchange.

Media Contacts:

Salomé Bronkhorst

salome.bronkhorst@sunexchange.com

Cell: +995 551 53 6380

WhatsApp: +27 79 388 2114

Caroline Skinner

caroline.skinner@sunexchange.com

US: +1 (650) 521-2577

ZA: +27 (064) 986-7019

About Sun Exchange:

Sun Exchange is an award-winning digital platform that enables simple, affordable, world-class solar power solutions for businesses and organisations in emerging markets. For more information visit www.SunExchange.com.

About ARCH Emerging Markets Partners Limited:

Founded in 2018 as a partnership between African Rainbow Capital Proprietary Limited and JCH & Partners LLP, ARCH Emerging Markets Partners Limited is an emerging markets investment advisory firm specialising in private equity opportunities with a primary focus on energy, logistics and natural resources in developing economies, and is regulated in the UK by the Financial Conduct Authority. For more information visit www.archempartners.com.